🌐 In today’s rapidly evolving digital landscape, understanding the intricacies of the outsourcing market has become crucial for businesses. This knowledge is essential for those striving to maintain competitive edges. It also plays a significant role in fostering innovation. In 2024, the outsourcing industry is poised to undergo transformative shifts. These changes will be influenced by advancing technologies and changing business priorities. Additionally, there is an increasing demand for specialized skills.

Intro

COVID-19 has prompted a shift in outsourcing strategies towards shoring up value and driving down costs while renewing the focus on risk management. The pandemic has forced organizations to reevaluate and often simplify their outsourcing priorities to emphasize cost-effectiveness and risk mitigation. The complexity of third-party ecosystems has grown, increasing the importance of effective supplier management. According to the World Economic Forum’s Global Risk Report, the pandemic has stressed the need for robust supplier management systems. These systems are essential to handle regulatory compliance, security risks, and data protection requirements. They must do so more effectively than before.

The Russia-Ukraine war disrupted the chances of global economic recovery from the COVID-19 pandemic, at least in the short term. The war between these two countries has led to economic sanctions on multiple countries. It has also caused a surge in commodity prices and supply chain disruptions. These factors are driving inflation across goods and services, affecting many markets across the globe.

Our comprehensive research delves into the outsourcing market for 2024 and the IT outsourcing revenue forecast. It aims to equip business entrepreneurs, web developers, and IT specialists with data-driven insights and strategic knowledge. This support will help them navigate this dynamic environment. By revealing this information, our audience can anticipate changes and make informed decisions. This will allow them to position themselves at the forefront of innovation in their respective fields.

⭐ Join us as we explore the future of outsourcing, uncovering opportunities and challenges that will shape the industry landscape in 2024 and beyond.

Introduction

IT outsourcing involves contracting out IT functions to external consulting companies or contractors. According to the Global IT Outsourcing Market Size, Status, and Forecast 2024–2031, this market segment is predicted to show significant growth, driven by factors such as cost reduction, access to global talent, and technological advancements. Analyzing its revenue trends provides insights into the health of the tech industry and the global economy.

👉 The global revenue in the ‘IT Outsourcing’ segment of the IT services market was forecast to continuously increase between 2024 and 2028 by in total 265.3 billion U.S. dollars (+51.77 percent). After the eighth consecutive increasing year, the indicator is estimated to reach 777.74 billion U.S. dollars and therefore a new peak in 2028.

👉 According to the Deloitte Global Outsourcing Survey, outsourcing can be broadly categorized into several types, reflecting the evolution in how organizations approach external partnerships for business operations.

Traditional Outsourcing

This is the conventional form of outsourcing, where specific tasks or services are contracted out to third-party vendors. This model focuses on the delegation of non-core functions to external providers. For example, many companies outsource their customer support, especially in retail and telecommunications. They do this to specialized firms that can efficiently handle large volumes of calls. These firms also manage inquiries effectively. Fivewalls is a software development company that has been active since 2015. We have developed multiple large projects, including internal management systems and marketing instruments. Additionally, we created logistics solutions. The company aims to provide expert assistance in custom software app development and management, anticipating and resolving issues before you ask. As a top software development company, according to Clutch, our team strives to handle the increasing demands for online business presence. We share expertise, tailor solutions to clients’ needs, and prioritize security and efficiency.

Managed Services

Under this model, organizations engage third-party providers not only to take over the management of certain functions but to improve them over time. This often includes comprehensive management of IT services, human resources, or customer support operations. For example, an IT-managed service provider might take complete responsibility for all IT services for a company. This includes management of infrastructure, cybersecurity, and network operations. Additionally, it encompasses technical support. This is not just about performing tasks but also ensuring that the IT operations align with the organization’s strategic goals. IBM provides comprehensive IT-managed services, including cloud services, data center operations, and IT support. Their services are designed to manage and optimize IT systems and operations, making them a prime example of managed services in the IT sector.

Operate Services

This newer model is a step further than managed services, where third-party providers offer end-to-end management of a business process or function. This type of outsourcing is increasingly integrated and aligned with the client company’s business outcomes. It offers not just service delivery but also strategic benefits. A common example would be cloud services, where the provider manages and continuously improves cloud infrastructure and related services. This often includes integration with existing business processes. Such integration is aimed at driving innovation and efficiency. Accenture provides end-to-end process operations services, including transformational services and ongoing operations management. Their offerings are geared toward enhancing business processes and delivering outcomes based on predefined standards.

Global In-House Centers (GICs)

Captive centers, known as Global In-house Centers (GICs), function as extensions of a business rather than external service providers. They handle various tasks, from software development to business processes, allowing the parent company greater control and closer integration. GICs are common in Eastern Europe, particularly in Ukraine, where companies tap into the local talent pool while retaining control over processes and intellectual property. Examples of companies with GICs in Ukraine and Eastern Europe include EPAM Systems, Luxoft, and Ciklum. These companies optimize costs and efficiency, benefiting from the region’s skilled IT workforce, favorable economic conditions, and strategic location.

Each of these outsourcing types represents a different level of collaboration and integration between the outsourcing company and the service provider, with a growing focus on strategic partnerships and operational excellence.

Historical Revenue Analysis (2019–2023)

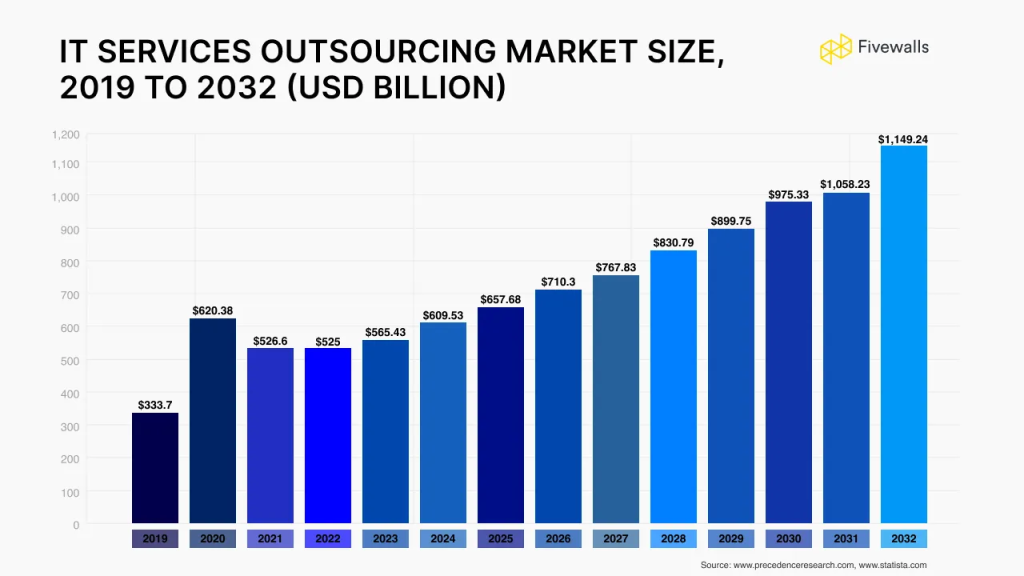

The historical revenue analysis for the outsourcing market from 2019 to 2023 reveals significant growth and transformation influenced by technological advancements and varying global economic conditions.

2019

n 2019, the outsourcing market was already on a growth trajectory. It benefited from digital transformation trends that emphasized efficiency. These trends focused on cost reduction across various industries.That year, the market was valued at USD 333.7 billion. It experienced steady growth despite the challenges posed by the global pandemic. While the pandemic initially slowed digital transformations across industries, it eventually accelerated them.

2020

As COVID-19 became a global pandemic in 2020, the outsourcing industry shifted towards digital operations. Companies leveraged outsourced services to mitigate lockdowns and economic slowdowns. The market experienced significant growth, reaching approximately USD 620.381 billion In 2020. COVID-19 accelerated the shift to remote working, cloud computing, and enhanced IT security. Businesses relied more on outsourced IT services for continuity and adaptation.

The increasing adoption of cloud migrations and cloud services has shifted IT outsourcing. It has moved from a simple cost-reduction tactic to a strategic component. This change is now integral to business growth. Additionally, this report on IT outsourcing notes a trend toward integrating offshore teams with on-site teams to improve agility, which refers to reducing businesses’ time to market.

2021 – 2022

In 2021, the global IT outsourcing market was valued at approximately USD 526.6 billion. According to Statista, the slight decline from the 2020 peak could be attributed to market stabilization after the unprecedented spike in IT demands due to the pandemic.

By 2022, this market size was estimated at approximately USD 525 billion. It shows a sustainability trend in the industry, driven by the adoption of cloud computing, robotic process automation (RPA), and artificial intelligence (AI). These technologies helped streamline operations and reduce costs, which was crucial during the uncertain economic times caused by the pandemic. The focus was particularly strong on BPO, which saw increased demand for customer service, finance, and accounting outsourcing services.

2023

In 2023, the global outsourcing market is highly valued across various segments, reflecting a vibrant and expanding sector. The IT outsourcing market alone was valued at approximately USD $575,2 billion.

Overall, the global outsourcing market is diversifying as businesses seek strategic partnerships that offer cost benefits, innovation, and access to new technologies. The shift from traditional BPO services to more KPO reflects broader changes in the global economic landscape.

Overall, the outsourcing market’s evolution from 2019 to 2023 showcases how businesses have increasingly relied on external providers. This reliance has allowed them to gain access to new technologies and specialized services, thereby driving revenue growth in this sector. Exploring comprehensive market reports is essential for more detailed insights into the outsourcing market’s trends and future outlook. These reports would provide deeper analyses and forecasts.

Current Market Analysis 2024

The global outsourcing market is experiencing significant growth, with a particular emphasis on the IT outsourcing sector. As of 2024, trends indicate a strong trajectory of expansion across various regions, fueled by technological advancements and changing business models. The IT Outsourcing Market size is expected to reach USD 617.69 billion by the end of 2024. This projection is based on the ongoing adoption of cloud computing, AI, and automation technologies. Moreover, geopolitical tensions and the global economic climate could play critical roles in shaping outsourcing strategies, particularly with companies looking to diversify their geographic risk.

Industry Shifts and Business Priorities

Businesses are evolving from traditional multi-vendor outsourcing to forming strategic partnerships that focus on high-quality service and long-term relationships. The rise of remote work has largely facilitated this shift, making outsourcing more accessible and diversified, and integrating remote resources with on-site operations to create a hybrid model.

In 2024, some of the major players operating in the global IT outsourcing market include well-known firms such as:

- IBM Corporation

- Hewlett Packard Enterprise Company

- Accenture plc

- VMware Inc.

- Cisco Systems Inc.

These companies are considered front runners due to their extensive service offerings, global presence, and strong brand reputations. They provide a wide range of outsourcing services, from cloud computing and IT infrastructure management to cybersecurity and customized IT solutions. These services cater to diverse industries worldwide.

Security and Compliance Challenges

With the increase in digital dependency, data security remains a crucial challenge. Companies and their outsourcing partners are investing more in cybersecurity measures to protect sensitive information and comply with regulatory changes. This includes implementing robust encryption protocols, regular security audits, and comprehensive training for all involved personnel.

The demand for outsourcing is expected to continue rising, driven by the need for cost efficiency, access to specialized skills, and the ability to scale operations flexibly. The market is adapting to more sophisticated business needs, including knowledge process outsourcing which involves high-level tasks such as R&D, data analysis, and decision support.

The outsourcing market in 2024 is set to grow, with IT outsourcing playing a pivotal role in this expansion. Companies are increasingly focusing on strategic partnerships and integrating advanced technologies to enhance their outsourcing strategies. As businesses worldwide adapt to these changes, the global outsourcing landscape is poised to offer numerous growth opportunities.

Future Predictions (2025–2028)

The IT outsourcing market is set for substantial growth from 2025 to 2029, driven by ongoing technological advancements and an increased demand for digital transformation across various industries. The market will continue expanding by integrating AI and ML, which aim to increase operational and service efficiencies. These technologies will transform traditional outsourcing models, reducing operational costs and enabling more personalized service offerings.

Moreover, the growing emphasis on cybersecurity and data protection regulations will compel outsourcing providers to significantly upgrade their security frameworks. This shift will ensure compliance with international standards and serve as a critical market differentiator. It will attract clients who prioritize data integrity and security.

Finally, sustainability and corporate responsibility will become crucial factors in vendor selection processes. Companies will prefer outsourcing partners who demonstrate strong commitments to environmental sustainability and ethical business practices. These predictions highlight a future where outsourcing is not just a means to cut costs but a strategic tool for innovation, risk management, and sustainable growth.

Market Growth and Regional Trends

👉 IT Outsourcing Market Growth. According to Mordor Intelligence, the IT outsourcing market will reach impressive figures in 2024 and continue growing at a steady rate through 2029. The adoption of cloud services, increased digital transformation, and the expanding use of ‘As-a-Service’ models are driving this growth. These models are becoming integral to many business operations.

North America and Europe are also anticipated to show significant growth, estimated at CAGRs of 3.7% and 3.3% respectively. These regions focus on outsourcing services that incorporate AI, ML, and automation to improve efficiency and reduce costs, shifting towards higher-value services such as research, development, and analytics.

Latin America and Eastern Europe are emerging as attractive regions for nearshoring due to cultural and temporal proximity to major U.S. and Western European markets, respectively. These regions are improving their IT infrastructure and expanding their talent pools, with projections showing a CAGR growth of around 5% and 4.2%, respectively. This growth is making them competitive alternatives to more established markets.

The global outsourcing market is diversifying as businesses seek strategic partnerships. These partnerships offer cost benefits, innovation, and access to new technologies. The shift from traditional BPO services to more knowledge-based outsourcing (KPO) is particularly pronounced in developed markets. This shift reflects broader changes in the global economic landscape.

Conclusion

The 2024 IT outsourcing market, projected at $512.47 billion, is shaped by technological advancements, evolving business needs, and COVID-19 impacts. AI and ML are enhancing operational efficiencies and client services, driving market value to an estimated $777.74 billion by 2028. Businesses increasingly leverage outsourcing for navigating the digital economy, risk mitigation, and cost efficiency. The shift to managed services reflects deeper engagement with outsourcing partners for strategic benefits. Leading companies like IBM and Accenture showcase cloud integration and end-to-end process management. Security, compliance, sustainability, and ethical practices are becoming key differentiators. The market’s growth hinges on emerging technologies, high-security standards, and sustainable practices.